How to Buy a Mobile App: A Founder's Guide to Smart Acquisitions

Buying a mobile app isn't just a transaction; it's a strategic leap into an established digital business. This move allows you to sidestep the grueling, high-risk process of building from scratch, acquiring a proven product with a built-in audience and, ideally, a steady stream of revenue. You're essentially fast-tracking your way to growth and profitability.

Your Blueprint for Buying a Mobile App

Welcome to the world of mobile app acquisitions. Buying an app is far more than just acquiring source code—it’s about taking the helm of a digital asset that has already carved out its space in the market. The initial grind of launching, finding product-market fit, and attracting your first users is brutal. When you buy an existing app, you skip that entire, often painful, chapter.

The Investor Mindset

To succeed, you need to think like an investor, not just a developer. You’re not starting from a blank canvas; you’re acquiring an asset that you can tune, polish, and grow. This perspective changes everything.

Your new focus becomes identifying and capitalizing on opportunities:

- Finding Hidden Gems: Spotting apps with a solid foundation but untapped potential.

- Boosting Revenue: Tweaking monetization through smarter pricing, better ad placements, or new subscription tiers.

- Refining the Experience: Making small changes that dramatically improve user loyalty and engagement.

- Scaling What Works: Taking a proven formula and amplifying its success by reaching new audiences or markets.

Buying a mobile app is about acquiring momentum. You're stepping onto a moving train rather than building one from scratch, giving you a head start towards your ultimate destination.

This guide is your roadmap for buying or selling a mobile app. We’ll walk through every critical stage, from finding the right deal and conducting thorough due diligence to valuation, negotiation, and the final handover. We'll cover the best practices that ensure a smooth, secure, and profitable transaction for both sides.

It's time to trade the builder's grind for the investor's playbook. Let's get you ready to find, evaluate, and acquire your perfect app.

Where to Find and Vet Your Next App Investment

So, you're ready to buy an app. The first big question is always the same: where do you even start looking? Not too long ago, this meant dealing with brokers and combing through forums, trying to decipher whether revenue screenshots were real. Thankfully, those days are over.

The entire game has changed. We're now in an era where you can make decisions based on real, live data, not just a seller's polished sales pitch. This shift has put the power squarely back in the hands of the buyer.

Say Goodbye to Blind Trust

The old way of buying an app was built on hope. A seller would send a PDF highlighting their best month, and you were left to hope the numbers were legitimate. It was a risky process.

Today's leading marketplaces have cut through that noise by prioritizing verified data. They plug directly into services like RevenueCat or the Apple App Store Connect using secure, read-only APIs. This isn't a summary or a screenshot; it's a live feed of an app's actual performance.

What does this mean for you, the buyer?

- Verified Revenue: You see exactly what the app is pulling in, updated in near real-time.

- Accurate MRR: Monthly Recurring Revenue is calculated for you, not just estimated by the seller.

- Live Subscriber Counts: You get a precise, current number of active subscribers.

This transparency takes the guesswork out of the equation. You can immediately build a shortlist of promising apps based on cold, hard facts instead of an optimistic forecast. It’s about starting the journey from a position of strength.

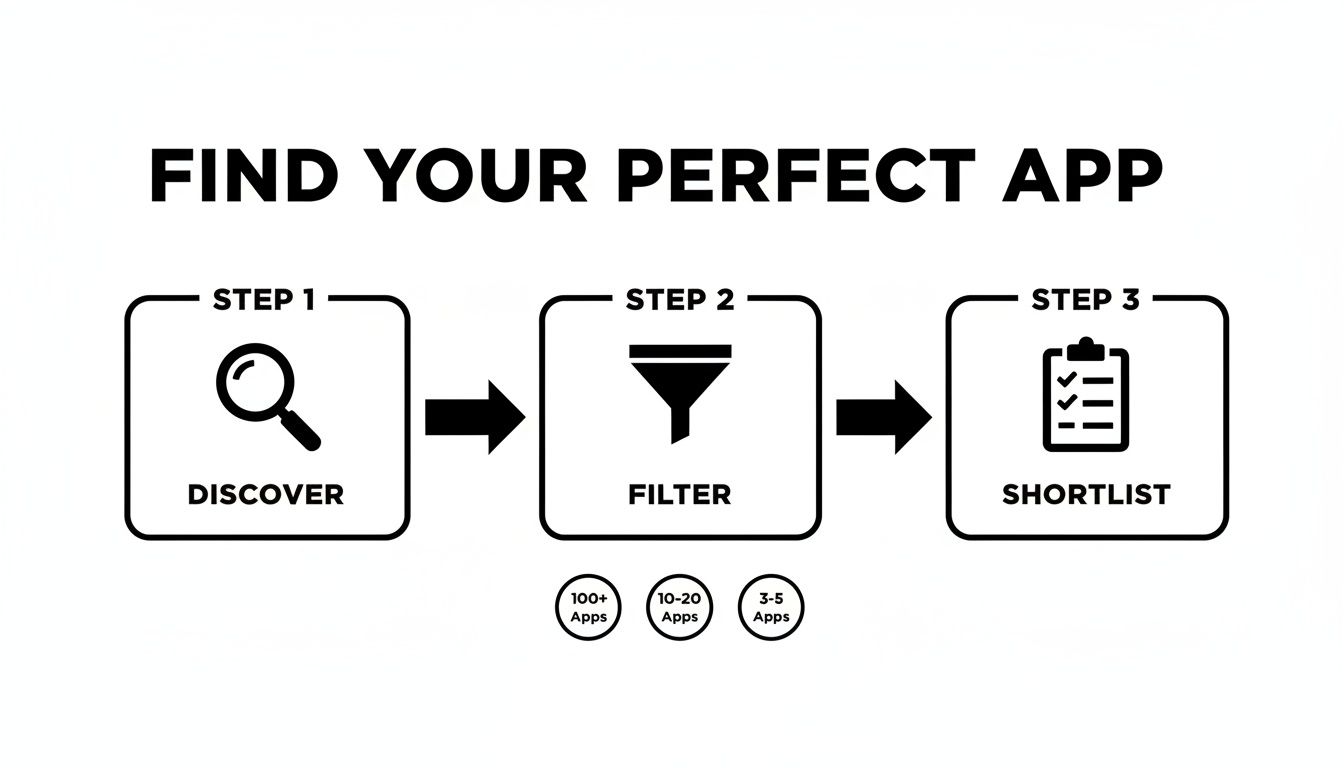

Filtering Down to the Perfect Fit

Once you have access to reliable data, the search process becomes incredibly efficient. You can stop wasting time on leads that don't align with your investment goals.

Think of it like having a live leaderboard of every app for sale. You can filter by:

- Category: Zero in on productivity, health and fitness, or entertainment.

- Business Model: Focus on subscription-based apps, those with in-app purchases, or ad-supported models.

- Key Metrics: Set your own minimums for revenue, MRR, or user growth.

This turns what used to be a random hunt into a focused, strategic search. You can spot undervalued gems and high-growth opportunities that others might have missed.

The modern app marketplace isn't just a classifieds list. It's a dynamic, verified database of real investment opportunities. The first question is no longer "who can I trust?" but "what does success look like for me?"

This trend towards verified data reflects the app economy's maturity. We’ve moved into a 'monetization-first' world where proven financial performance is king. Consider this: in 2025, global mobile in-app purchase revenue soared to an incredible $167 billion, a 10.6% jump from the previous year, while app downloads grew by only 0.8%.

This tells us that real growth now comes from engagement and value, not just downloads. For an investor, this makes it absolutely critical to validate an app's revenue streams from the start. You can get more context on these trends by exploring the state of the mobile economy on pocketgamer.biz. Using platforms with verified data plugs you directly into the metrics that define a successful app today.

Mastering the Art of Due Diligence

You've found an app that looks like a winner. The listing is polished, the numbers seem solid, and you're already picturing its potential. Now comes the most important part of the entire journey: due diligence.

This isn't just about ticking boxes. It's about becoming a detective. You're looking under the hood, checking the foundation, and making sure the shiny exterior isn't hiding a rusty engine. Getting this right is what separates a smart investment from a costly mistake. The goal is to move from a promising candidate to a thoroughly vetted opportunity you can acquire with confidence.

Think of it as a funnel. You start with a wide pool of options, apply your criteria, and systematically narrow it down until only the best of the best remain.

The Gold Standard: Verifying the Financials

Let's start with the money, because if the numbers don't hold up, nothing else matters. In the past, buyers had to rely on exported spreadsheets and screenshots—a system begging for manipulation.

Those days are over.

Today, the only verification method you should accept is read-only API access. When a seller connects their RevenueCat or app store accounts to a reputable marketplace, the platform pulls financial data directly from the source. It’s unchangeable, untampered, and completely objective.

This direct feed gives you the ground truth on the metrics that count:

- Monthly Recurring Revenue (MRR): Is it on an upward trend, flat, or quietly declining?

- Active Subscriptions: How many people are actually paying for this thing, month after month?

- Revenue Sources: Is the income from subscriptions, one-time purchases, or ad revenue?

Unverified revenue is just a story. Verified revenue is a fact. Always, always insist on the facts. It’s the only way to ensure your decision is based on reality, not a well-crafted fantasy.

With global app marketing spend hitting $109 billion in 2025 and total app market revenue reaching a staggering $330.61 billion, there's too much at stake to rely on trust alone. Platforms that integrate with these APIs are your best friend here, giving you a crystal-clear picture of what you’re actually buying. You can explore more trends on the 2025 mobile consumer market on sensortower.com.

Your Comprehensive Due Diligence Checklist

To make sure you don't miss anything, it helps to have a structured plan. I've put together a checklist that breaks down the due diligence process into four core pillars: Financial, Technical, User Metrics, and Legal.

Use this table as your guide to ask the right questions and spot potential problems before they become your problems.

| Category | Key Item to Verify | Why It Matters | Red Flag Example |

|---|---|---|---|

| Financial | MRR & Revenue via read-only API access. | Guarantees the numbers are real and not doctored. | Seller provides only screenshots or CSV exports of their payment processor. |

| Technical | Code Quality & Tech Stack health audit. | A messy or outdated codebase will be a nightmare to update and maintain. | The app is built on a deprecated framework no one uses anymore. |

| User Metrics | Retention & Churn Rates from analytics. | Reveals if users actually stick around or if it's a "leaky bucket." | High downloads but a 90% drop-off in users after the first week. |

| Legal | Intellectual Property (IP) Ownership. | You need to be 100% sure the seller has the legal right to sell the entire app. | The seller used a copyrighted library without a commercial license. |

This checklist is your roadmap. Following it diligently will give you the clarity and confidence needed to make a smart, informed offer. For a more exhaustive breakdown, check out our complete guide on the essential due diligence checklist.

Diving Deeper: What the Checklist Reveals

The Technical Teardown

An app with fantastic revenue can still be a ticking time bomb if its technical foundation is crumbling. Your mission is to uncover the app's true health and how difficult it will be to maintain or improve. Focus on:

- Code Quality: Is it clean and well-documented? Or is it a tangled mess that will cost a fortune to update?

- Tech Stack: Is the app built with modern, supported technologies? An app built on an old, abandoned framework is a massive liability.

- Technical Debt: This is the hidden cost of quick fixes made in the past. High technical debt can bring future development to a grinding halt.

- Crash Reports & Bugs: Every app has bugs, but a high crash rate or a long list of unresolved issues points to deep-seated problems.

If you don't have the technical chops, hire a freelance developer for a few hours to do a code audit. It’s one of the best investments you can make in this process.

The User Base Health Check

Downloads are a vanity metric. A healthy business is built on an engaged, loyal user base. Dig into the metrics that show you the truth:

- Engagement (DAU/MAU): How many people are opening the app daily versus monthly? This ratio tells you how sticky the product is.

- Retention Rate: What percentage of users come back after day 1, week 1, and month 1? Strong retention is the hallmark of a product people love.

- Churn Rate: How many subscribers cancel every month? A high churn rate means you're constantly fighting to replace lost customers.

- User Reviews: Don't just look at the star rating. Read the actual reviews. Recurring complaints about bugs, missing features, or terrible support are waving a giant red flag.

The Final Hurdle: Legal & Compliance

This is the final, crucial check. Overlooking legal details can expose you to enormous risk. First, confirm that the seller owns 100% of the intellectual property—the code, the name, the logo, everything. Make sure they have the undisputed right to sell it all to you. Next, verify compliance with data privacy laws like GDPR and CCPA. Mishandling user data can lead to eye-watering fines and destroy user trust.

Valuing an App and Structuring a Smart Deal

So, how much is an app really worth? Nailing down a price is a mix of solid data and savvy strategy. A good valuation gives you the confidence to make a fair offer, while a well-structured deal protects your investment and sets you up for success.

The most common starting point is a multiple of the app's Seller's Discretionary Earnings (SDE). Think of SDE as the total cash flow the business generates for its owner. You calculate it by taking the net profit and adding back expenses that a new owner wouldn't have, like the previous owner's salary or one-off costs. Once you have that SDE number, you apply a multiple.

Determining the Right Multiple

For most mobile apps, you'll see multiples in the 2x to 5x range of their annual SDE. An app with flat growth might barely hit the low end. On the other hand, a fast-growing app with a die-hard subscriber base could easily command a premium.

What pushes that number up or down?

- Growth Rate: Is revenue climbing month after month? Consistent, organic growth is the number one sign of a healthy app.

- User Base Quality: A small, engaged group of long-term subscribers is more valuable than a giant list of free users.

- Market Trends: An app in a hot niche, like AI-powered tools, will naturally fetch a higher multiple.

- Monetization Model: Predictable, recurring revenue is king. Subscription models are the gold standard.

A valuation is more than just a formula; it’s a story told through data. The higher the quality of the revenue and the stronger the growth trajectory, the more compelling that story becomes to a buyer.

The shift to subscriptions has completely changed the game. Subscription apps are projected to bring in over $140 billion annually by 2025 with a blistering 20% year-over-year growth. This recurring revenue offers stability that one-time purchases can't match. This is where platforms like what's the app are invaluable, providing leaderboards with verified subscription metrics that let you evaluate an app with numbers you can trust. For an even deeper look at the data driving the app economy, you can discover more insights about mobile app statistics on appmysite.com.

Crafting a Deal That Protects Everyone

Once you have a valuation in mind, the structure of the deal becomes just as important as the price. A smart deal structure minimizes risk for both you and the seller, creating a win-win.

Asset Sale vs. Stock Sale

For almost every indie app acquisition, you'll be doing an asset sale. This means you're purchasing the specific assets of the business—the source code, user data, app store listings—but not the seller's company itself. This is a much cleaner and safer route, because you don’t inherit any of the seller’s hidden liabilities or old debts. A stock sale, where you buy the entire company, is far more complicated and usually reserved for larger acquisitions.

The Power of Seller Financing

Sometimes, a seller might agree to finance a portion of the purchase price themselves. This is called seller financing. For example, you might pay 80% of the price upfront, and the remaining 20% is paid out in installments over the next 12 months.

This can be a fantastic setup for a few reasons:

- It aligns incentives. The seller now has a vested interest in a smooth transition.

- It shows the seller's confidence. If they believe in the app's future, they'll be more open to this deal.

- It can make the deal more affordable. It lowers the amount of cash you need on closing day.

Defining Clear Transition Terms

Finally, your deal has to include a crystal-clear transition plan. This section should spell out exactly what the seller will do to help you after the sale and for how long. A standard transition period is often between 30 and 90 days. During this time, the seller's job is to be your guide, getting you up to speed on everything from the tech stack to common customer support issues. Get it all in writing. You can find more guidance by exploring our detailed look at app valuation methods.

Handing Over the Keys: The Art of a Seamless Transfer

The deal is signed. The negotiation is over. Now comes the moment that turns a promising acquisition into a real-world success. Executing a flawless handover is more than a technical formality; it’s about protecting the very value you just acquired. A clumsy transfer can frustrate users and kill the app's momentum overnight.

You're about to step into the owner's shoes. This final phase requires surgical precision, from locking down the funds to migrating every last digital asset. A smooth transition is your first big win.

Secure the Deal with an Escrow Safety Net

Before a single line of code is transferred, your first move is to secure the payment through a trusted escrow service. This is non-negotiable. It’s the ultimate safety net that protects both you and the seller.

The process is simple:

- You place the full purchase price into the secure escrow account.

- The escrow agent confirms the funds are locked, giving the seller the green light to transfer assets.

- The seller begins transferring all agreed-upon assets to you.

- Once you’ve confirmed you have everything, you give final approval for escrow to release the payment.

This completely removes the "who goes first?" dilemma. Escrow creates a neutral territory where everyone can act with confidence.

The App Store Handover

Transferring the app store listing is one of the most delicate parts of the acquisition. The goal is a transition so seamless that users don't notice, preserving years of hard-earned rankings, reviews, and user history. Both Apple and Google have well-defined processes for this.

For the Apple App Store: The seller initiates the transfer from their App Store Connect dashboard. You'll provide your Apple Developer Team ID and associated email. The app simply appears in your account, history and all.

For the Google Play Store: The process is very similar. The seller initiates a transfer request through their Play Console. The outcome is the same: a seamless handover that keeps the app’s store presence perfectly intact.

A perfect app store transfer is one that your users never even notice. No interruptions, no lost data—just business as usual. That's the gold standard.

Assembling All the Digital Keys

An app is an ecosystem of code, databases, and third-party services. A huge part of the takeover is making sure you get the keys to every single part of that kingdom.

Your transfer checklist needs to be airtight. Here’s what you must secure:

- Source Code: Full access to the most recent codebase, typically through a repository transfer on GitHub or Bitbucket.

- Backend & Databases: Root credentials and ownership of any servers, databases, or cloud infrastructure like AWS or Firebase.

- Third-Party Accounts: Logins for every single integrated service—analytics platforms, ad networks, push notification providers, and crash reporting tools.

- Social Media & Domains: Full ownership of every social media profile, the official domain name, and any customer support email inboxes.

This is all about gaining complete operational control. As soon as the assets are in your hands, change every password and enable two-factor authentication everywhere you can.

To ensure you don’t miss a thing, this comprehensive app transfer checklist is an invaluable resource. Use it to tick every box before you authorize that final payment from escrow.

Your First 90 Days as the New App Owner

Congratulations! The deal is done, the accounts are yours, and you're officially the new owner. This is where the real work—and fun—begins.

Those first three months are your proving ground. This is the critical window to build momentum, establish stability, and set the stage for growth. Forget about reinventing the wheel right away. Your initial focus should be on listening, learning, and executing smart, deliberate moves. The goal is a seamless transition that keeps users happy and protects the revenue you just acquired.

The First 30 Days: Listen and Learn

Your first month is all about absorption. Before you touch the code, you need to get a feel for the app's natural rhythm. Dive into the analytics. Read every single user review, especially the bad ones. Get to know the community built around this product.

Your top priorities right now should be:

- Mastering the Machine: Get familiar with the tech stack, the customer support process, and all the operational routines.

- Connecting with People: If any developers or contractors came with the deal, build a real connection. Understand what they do and what they know.

- Communicating with Users (Carefully): Often, the quietest transition is the best one. But if the ownership change is public, a short, confident message about the app's bright future can build goodwill.

The Next 60 Days: Identify and Execute

Now it's time to start making your mark. Your focus should shift to finding "low-hanging fruit"—quick, impactful wins that can boost the user experience without a massive overhaul.

Your early wins are about demonstrating competence and building momentum. Small, visible improvements show your user base that you're invested in the app's future and are actively making it better.

Start looking for those easy victories. Maybe it's fixing an annoying bug users have complained about for months. Perhaps you can optimize the onboarding flow to see a bump in retention. You might even A/B test a small tweak to the pricing page.

These initial actions don't just stabilize the asset; they pave the way for your more ambitious, long-term vision. This period proves that when you buy a mobile app, you're not just getting code—you're stepping up to lead a community.

Your App-Buying Questions, Answered

Jumping into the world of app acquisitions is an exciting step. It's normal to have questions as you get started. Let's tackle some of the most common ones.

How Long Does It Take to Buy an App?

The honest answer is: it depends. That said, most deals wrap up somewhere between four to eight weeks. This timeframe covers everything from finding the right app and digging into due diligence, to negotiating the price and completing the technical transfer. If both the buyer and seller are motivated and prepared, the process can be faster.

What Are the Biggest Risks Involved?

The two biggest risks when buying an app are overpaying and discovering hidden problems after the deal is done. The best way to protect yourself is by insisting on API-verified revenue data. This connects directly to the app stores and payment gateways to show you real, untampered numbers. Pair that with a solid technical audit to ensure the code is clean, and you've sidestepped the biggest landmines.

The most successful acquisitions are built on a foundation of verified data and meticulous due diligence. Trust the numbers, verify the code, and you'll confidently step into your new role as an app owner.

This isn't just about avoiding risk—it's about turning your investment into a smart, calculated move that sets you up for an incredible future.

Ready to find your next app investment with total transparency? Explore live, verified app metrics on what's the app and make your next acquisition a data-driven success.