What Is the Real Simple App Cost to Buy or Sell an App

So, you’re looking into the value of a “simple” app. It’s a common starting point, whether you're planning to buy an existing app or sell one you've built. While the initial development cost for a basic app can run anywhere from $15,000 to over $50,000, that figure is just a historical fact. When it comes to buying and selling, the real value lies elsewhere.

The smartest buyers and sellers stop seeing an app as a one-time project and start treating it as what it is: a living, breathing business asset. This guide will walk you through the best practices for buying and selling a mobile app, focusing on what truly drives its market price.

Beyond the Code: Uncovering an App's True Worth

Valuing an app for a sale is like assessing a physical storefront. The original construction bill is interesting, but it doesn't set the sale price. The real value is in the location, the recurring foot traffic, and the profit it generates month after month.

An app is no different. Its market value is a dynamic figure, shaped by the quality of its creation, its ongoing upkeep, and its potential in the market.

This mindset shift is everything—whether you're buying an existing app or preparing to sell your own. In an industry that's exploding—projected to grow from $252.89 billion in 2023 to over $300 billion by 2026—understanding the complete financial picture is your biggest advantage. For a closer look at the sheer scale of this opportunity, you can explore more transformative mobile app statistics.

From Sunk Cost to Active Investment

When an app is on the market, the conversation changes. The initial build cost fades into the background, and its real-world performance takes center stage. You're no longer talking about past expenses; you're talking about a transferable asset.

This guide explores the total cost of ownership and, more importantly, how to determine what an app is actually worth on the open market, providing best practices for both buyers and sellers.

An app's valuation is ultimately a reflection of its ability to generate future cash flow. The initial development cost is a sunk cost; what the market truly cares about is verified revenue, user engagement, and growth potential.

To make a smart deal, you have to look beyond the code. The factors that truly drive an app's sale price are:

- Verified Revenue: Consistent monthly recurring revenue (MRR) is the single biggest driver of value.

- Operational Costs: What does it cost to keep the lights on? Servers, APIs, and maintenance all impact the bottom line.

- Market Position: The app's niche, level of competition, and potential for growth play a huge role in how desirable it is to a buyer.

Focusing on these elements is crucial for both sides of the transaction. To get a much deeper dive into the valuation process, check out our guide on comprehensive app valuation.

The Building Blocks That Define App Value

When you're looking at buying or selling an app, it's easy to get fixated on the price tag. But that initial development cost? It’s not just a number on a spreadsheet from the past—it's the very foundation of the app's current value. A clean, simple interface can easily hide thousands of hours of painstaking engineering, and seeing that hidden effort is what separates a smart deal from a bad one.

If you’re the seller, being able to walk a potential buyer through the thought and investment that went into every feature is how you justify your asking price. It’s about showing them the quality under the hood.

For buyers, this is where your real homework begins. You're not just acquiring a pretty icon on a screen. You're taking on a codebase, a backend infrastructure, and a whole history of design choices that will either set you up for success or bog you down. A cheaply built app might look appealing, but it could be riddled with technical debt—a developer's term for the future cost of fixing problems caused by taking shortcuts today.

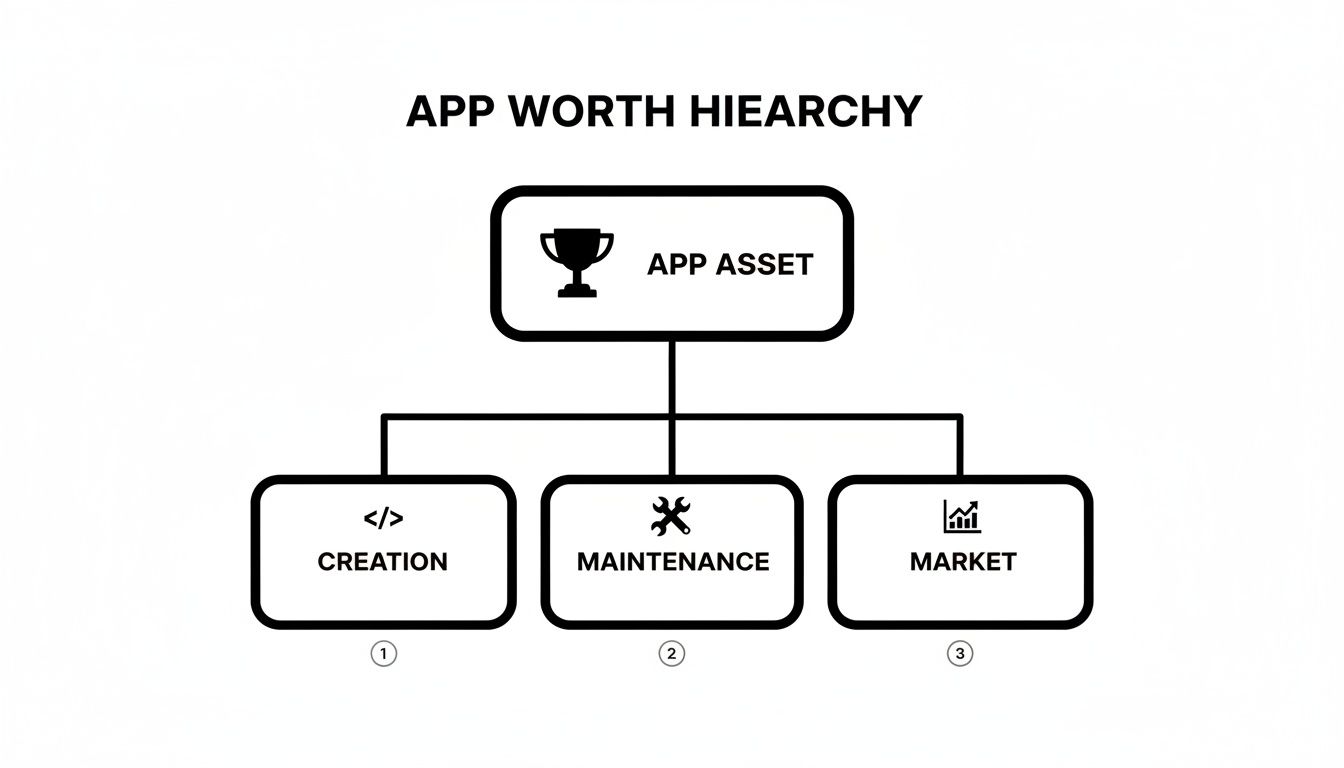

Think of an app's total value as a structure built on three core pillars: its initial creation, its ongoing maintenance, and its ability to compete in the market.

As you can see, that first build is just the starting point. But it directly impacts how much you'll spend and how much you can grow later. A solid foundation makes for an easier-to-maintain house and gives you a much better shot at thriving in the neighborhood.

Decoding the Development Investment

So, what are these fundamental building blocks we're talking about? They're the non-negotiable phases of creation that every buyer should dig into and every seller should be ready to showcase. Getting a handle on these is absolutely essential before money ever changes hands.

UI/UX Design: This is so much more than picking colors and fonts. A real investment here means the app was meticulously crafted around how people actually behave, resulting in an experience that just feels right and keeps users coming back. For a buyer, a thoughtfully designed app almost always means spending less to attract and keep customers.

Front-End and Back-End Engineering: The front-end is everything your users see and touch. The back-end is the engine room—the servers, databases, and logic that make it all work. A seller who can present a clean, well-documented codebase is essentially handing you a reliable, scalable asset, not a ticking time bomb.

Platform Choice (iOS vs. Android): The decision to build natively for one or both platforms, or to go with a cross-platform framework, has a huge ripple effect on performance and long-term costs. Native apps typically cost more upfront but deliver that buttery-smooth experience users love, which can be a massive selling point. You can dive deeper into this decision in our guide on buying mobile apps.

When you’re sizing up an app for purchase, the quality of its code is a direct signal of its long-term health. A cheap, rushed build will bleed you dry with bug fixes and frustrated users, costing you far more down the road than a well-engineered app costs today.

Ultimately, the true "simple app cost" is a story told by how it was built. If you're a buyer, learning to read that story helps you distinguish a diamond in the rough from a money pit. And if you're a seller, telling that story well is how you turn yesterday’s hard work into today's profit.

How Your Team Choice Affects Your App's Payout

When someone's ready to buy your app, they aren't just looking at the flashy user numbers or the revenue. They're peeling back the layers to see how it was built. The story of your app's creation—whether you hired a freelancer, a dedicated agency, or built an in-house team—tells a potential buyer everything they need to know about its quality and what it'll be like to own.

It’s a bit like buying a house. A home built by a master architect with detailed blueprints and a single, unified vision inspires a ton of confidence. But a house that’s been renovated by a dozen different contractors over the years? You start to wonder what’s lurking behind the drywall. Both might look great on the surface, but the one with a solid, proven foundation is always going to be worth more.

The Freelancer Route: A Patchwork Puzzle

Going with freelancers is a super common and often budget-friendly way to get your first version out the door. No doubt about it. The challenge pops up later, when you're sitting at the negotiating table. A potential buyer is going to want to see a clean, well-documented, and consistent codebase.

If your app was pieced together by several different freelancers over time, each with their own unique coding habits and style, it can feel like a jumbled puzzle to the buyer's technical team. This immediately raises red flags and introduces risk.

They'll be asking themselves:

- Can our team even understand this code, let alone maintain it?

- Is the intellectual property all buttoned up, or are we inheriting a legal mess?

- If we try to add a new feature, is the whole thing going to fall apart?

To get top dollar, you’ll need to have your ducks in a row with immaculate documentation, proof of IP ownership, and a clear story that connects all the freelance work into one cohesive product.

The Agency Advantage: A Premium on Peace of Mind

Working with a professional app development agency usually means a higher upfront cost, but that investment can seriously pay for itself when you decide to sell. A great agency doesn't just write code; they bring a proven process, standardized practices, and meticulous documentation from day one.

An app from a well-respected agency comes with a built-in seal of approval. Buyers see it as a de-risked investment because it signals a professional, scalable, and well-architected foundation, which absolutely justifies a higher price tag.

For a buyer, an agency-built app is simply the safer, smarter bet. The code is almost always cleaner, the architecture is built to last, and there's a clear paper trail for every single decision. This predictability makes your app a far more attractive asset. The new owner knows they can hit the ground running and build on what you started, without worrying the whole thing will crumble beneath them. That confidence? That’s what can dramatically boost your final selling price.

Uncovering the Hidden Costs of App Ownership

The moment an app changes hands is thrilling, but it’s just the starting line, not the finish. Whether you're buying or selling, the true cost of an app reveals itself over the long haul. The initial transaction is a single event; ownership is a continuous commitment.

Think of it like buying a rental property. The purchase price is obvious, but what really determines your profit are the ongoing expenses—property taxes, maintenance, insurance, and management fees. An app is exactly the same. Its long-term value depends on a clear-eyed view of the essential, recurring costs that keep it running smoothly and securely.

The Seller's Responsibility: Transparency Builds Trust

If you're selling your app, laying out these operational costs with total honesty is non-negotiable. It’s not just good practice; it’s how you build credibility and justify your asking price. A smart buyer isn't just looking at your revenue—they're calculating their potential return on investment, which is impossible without knowing the expenses.

Providing a clear, documented list of these costs shows you’ve run your app like a real business. This proactive honesty reassures buyers they aren't about to step into a financial minefield, making them far more confident in their decision to move forward.

The Buyer's Due Diligence: Calculating True Profitability

As a buyer, this is where your attention to detail matters most. Getting a crystal-clear picture of an app's operating expenses is the only way to understand its actual profit margin. Your goal is to uncover every single recurring cost that will hit your bank account after the deal is done.

A comprehensive view of these hidden costs is vital. You can find more guidance on what to look for in our detailed due diligence checklist for buying an app.

A profitable app isn't defined by its revenue alone, but by the difference between its revenue and its total operational costs. Overlooking even minor recurring fees can erode your margins and turn a promising investment into a financial drain.

Be ready to ask pointed questions and dig into the specifics. Here are some of the most common ongoing expenses you'll encounter:

- Server and Hosting Fees: What does it cost to keep the lights on? This includes cloud services like AWS or Firebase, which can easily fluctuate based on user traffic.

- Database Maintenance: Who manages the database? What are the associated costs for storage, backups, and performance tuning?

- Third-Party API Subscriptions: Many apps lean on external services for maps, analytics, or payment processing. These almost always come with monthly or usage-based fees that can add up.

- Mandatory OS Updates: When Apple or Google releases a major OS update, your app will likely need tweaks to stay compatible. That requires developer time, which costs money.

- App Store Fees: Don’t forget the annual developer program fees—$99/year for Apple and a $25 one-time fee for Google Play.

For any buyer or seller, mastering these details is the key. It turns the abstract idea of an app's cost into a tangible, predictable financial reality, paving the way for a successful and profitable journey for everyone involved.

How Revenue Transforms Cost Into an Investment

This is the moment the whole conversation about app cost flips on its head. As soon as an app starts bringing in consistent, verifiable revenue, that initial development price tag becomes a historical footnote.

The focus shifts, and it shifts hard, from what was spent to what it’s earning. Suddenly, you're not talking about build costs anymore; you're talking the language of value: metrics like Monthly Recurring Revenue (MRR), customer lifetime value (LTV), and how much it costs to acquire a new user (CAC). An app that cost $20,000 to create but is now pulling in a steady $5,000 in MRR isn't a $20,000 app. It's an income-producing asset with a market value many times that initial cost.

From Sunk Cost to Cash-Flowing Asset

That transition is the most powerful moment in any app's journey. For anyone looking to buy or sell an app, the ability to anchor its value in cold, hard financial data is what turns a speculative gamble into a calculated investment. The market simply doesn't care how much you spent; it cares about how much you're making.

This is especially true today, where subscriptions and freemium models reign supreme. Believe it or not, about 98% of all mobile app revenue worldwide comes from freemium apps that make their money through ads, in-app purchases, or subscriptions. With consumer spending on apps projected to smash past USD 150 billion by 2025, the potential for even a "simple" app to become a serious asset is huge. You can dig into more of these powerful mobile app development statistics to see just how big the opportunity is.

Using Verified Data to Set a Fair Price

So, how do you unlock that value? The secret is verified data. Platforms that can plug directly into an app's financial metrics in real-time remove all the guesswork. They build instant trust between a potential buyer and a seller because the numbers are right there for everyone to see. This transparency allows for a valuation based on a simple, powerful formula—not a gut feeling.

Here’s a glimpse of how a marketplace like What's the App lays out this verified data for potential buyers.

This kind of dashboard immediately puts the spotlight on what matters: revenue performance. It showcases the MRR, active trials, and subscription trends—the true drivers of an app's market value.

Instead of getting bogged down debating the original development cost, everyone can focus on the app's current health and future potential. This is exactly how a "simple app cost" evolves from an expense into a tangible, high-growth investment.

Once an app generates profit, its value is a multiple of that profit, not a reflection of its build cost. A buyer is acquiring future cash flow, and the price should reflect the size and stability of that income stream.

This data-first approach gives sellers the power to command a price based on proven performance. For buyers, it delivers the confidence to make a smart acquisition, knowing the numbers are real and the potential for a return is clear. The initial development cost? It just becomes part of the asset's origin story.

Finding Your Niche for Higher Market Value

It's a truth every app entrepreneur learns: not all apps are created equal. A simple, focused app in a hot, growing niche can be worth far more than a complex one fighting for attention in a crowded market. Whether you're building, buying, or selling, understanding this dynamic is your secret weapon.

Think of it like real estate. Would you rather own a small, specialized coffee cart in a booming new business district with zero competition, or a huge, fancy cafe in a neighborhood that already has ten others? The little cart with a captive audience has a much clearer—and more valuable—path to profit. It’s not just about the features; it's all about the opportunity.

Assessing Market Potential Before a Sale

If you're looking to sell, how you frame your app is everything. Don't just talk about what it does; talk about the market it serves. You need to highlight its unique position and its potential to grow. A buyer isn't just purchasing your code; they're buying a foothold in a specific market.

For buyers, this is where you can find absolute gold. An app might seem modest at first glance, but if it’s thriving in a high-growth niche, you're not just buying an app—you're buying a ticket on a rocket ship. The real skill is spotting categories with a high ceiling and a strong, defensible position.

An app's value isn't just its current revenue. It's the size of its Total Addressable Market (TAM). A buyer is paying for future growth, so showing them a clear path to capturing a bigger piece of that pie will massively increase your app's sale price.

The data tells a compelling story about where the money is. For instance, mobile games make up only 13-14% of all apps but pull in a staggering 38-41% of total app store earnings. And check this out: voice assistant apps are projected to explode from USD 6 billion in 2024 to USD 87.5 billion by 2034. You can dig into more of these transformative mobile app statistics to find your own hidden gem.

At the end of the day, a smart deal is built on foresight. The "simple app cost" is almost an afterthought when the market opportunity is enormous. Your most important job, whether you're on the buying or selling side, is to become an expert on your app’s niche.

Frequently Asked Questions About Selling Your App

So, you've built your app, and now you're wondering what comes next. Maybe you're looking to sell your creation, or perhaps you're on the other side, searching for a digital asset to invest in. Let's clear up some of the most common questions that pop up when an app is ready to change hands.

The journey from building an app to selling it is all about shifting your perspective from creator to investor.

What Is the Most Important Factor in an App's Sale Price?

When it comes down to it, one thing stands above all else: verified recurring revenue. It’s the single most important factor. While your initial development cost hints at the app's quality and complexity, a potential buyer is laser-focused on one thing: how much money will this make me?

An app that consistently brings in cash, with numbers to back it up, is infinitely more attractive than an app with untapped potential but zero profit.

Think of it this way: a buyer isn't just buying code; they're buying a money-making machine. The more predictable and proven that machine is, the less risk they take on, and the more they're willing to pay.

How Do I Prepare My App for Sale?

Getting your app ready to sell is a lot like staging a house before putting it on the market. You want to make it as appealing and straightforward as possible for the next owner. A little prep work goes a long way.

Here’s what you need to do to get your affairs in order:

- Get Your Financials Straight: Compile clean, verifiable records of every dollar that has come in and gone out. No fuzzy math allowed.

- Clean Up the Code: Make sure your codebase is well-documented and organized. A new developer should be able to jump in without wanting to pull their hair out.

- Gather Your Paperwork: Confirm that you legally own all the intellectual property (IP)—the code, the design, the name, everything.

- Be Radically Transparent: Create a simple list of all ongoing costs, from server hosting to third-party API fees. Being upfront builds trust and makes the whole process smoother for everyone involved.

Taking these steps transforms your app from a passion project into a turnkey business, ready for a new owner to take the reins. It’s the best way to get the highest possible price when you decide to sell.

Ready to see what your app is truly worth or find your next investment? At What's the App :)?, we connect buyers and sellers using transparent, verified revenue data. Explore the marketplace today.