Buying & Selling Mobile Apps: The Definitive Guide for 2024

Welcome to the new era of app acquisitions. The old playbook of chasing high download counts and massive user bases is officially obsolete. Today, smart founders and investors on both sides of the table are focused on one thing: verified, sustainable income. Whether you are buying or selling a mobile app, it's time to reset your perspective and focus on what truly builds value.

The Modern Marketplace for Buying and Selling Apps

The market for buying and selling apps has matured. It's no longer a volume game; it's a value game. A few years ago, an app with a million downloads might have been an exciting prospect. Now, those are just vanity metrics unless they connect directly to a healthy bottom line.

This shift was driven by a savvier market that learned popularity doesn't pay the bills—profitability does. The spotlight is now firmly on apps that can prove they generate consistent, predictable cash flow. This is the new gold standard for both buyers and sellers.

From Downloads to Dollars: The New Currency

The entire app ecosystem is evolving. For the first time, non-game apps are bringing in more revenue than games, signaling a major shift in consumer spending habits.

The numbers don't lie. Global in-app purchase revenue recently hit a staggering $167 billion, growing at a healthy 10.6%. Meanwhile, new app downloads barely budged, growing by only 0.8%. The message is loud and clear: monetization and quality have officially overtaken sheer volume. You can dig deeper into this monetization-first trend over on PocketGamer.biz.

This new reality creates incredible opportunities. For buyers, it means acquiring a real, functioning business. For sellers, it means you can command a premium for a well-run, profitable asset.

The single most important principle in the modern app marketplace is this: An app with $10,000 in verified Monthly Recurring Revenue (MRR) is infinitely more valuable than an app with a million free users and zero income.

Best Practices: Old Metrics vs. New Gold Standards

The shift from vanity metrics to revenue-focused data is the most critical change in the app M&A space. Understanding this difference is what separates a risky gamble from a sound transaction.

| Metric Category | Old Metric (The Trap) | New Gold Standard (The Opportunity) |

|---|---|---|

| User Base | Total Downloads | Monthly Active Users (MAU) & Paying Subscribers |

| Engagement | Daily Active Users (DAU) | User Lifetime Value (LTV) & Churn Rate |

| Financial Health | Ad Impressions | Monthly Recurring Revenue (MRR) & Net Profit |

| Growth Signal | Download Velocity | LTV to CAC (Customer Acquisition Cost) Ratio |

Focusing on the "New Gold Standard" column ensures you're evaluating the core business, not just its surface-level popularity. This is the foundation for any successful transaction.

Why Verified Data is the Cornerstone of Every Deal

The emergence of platforms offering transparent, verified financial data has completely changed the game. By connecting directly to the source—whether it’s RevenueCat, the app stores, or payment processors—these marketplaces eliminate guesswork and build a crucial foundation of trust.

This level of transparency is a win-win for everyone involved in buying or selling mobile apps:

- For Buyers: You assess opportunities based on real numbers, not hopeful projections. This cuts risk dramatically and makes due diligence faster and more reliable.

- For Sellers: You attract serious, well-funded buyers ready to pay a premium for a business with financials they can trust from day one. It proves your app is a high-quality asset.

Insisting on verified data is the bedrock of any intelligent M&A strategy. It ensures the investment is built on solid ground.

Best Practices for Finding and Vetting an App

Finding the right app to buy is a blend of sharp analysis and founder intuition. Your goal is to unearth that hidden gem—an asset with real momentum. The old way involved sifting through marketplaces with inflated or fabricated revenue claims. Today, the smart money starts where the data is verified at the source.

Sourcing Deals from a Position of Strength

Your search should begin on marketplaces that plug directly into an app's financial nervous system—platforms like RevenueCat, Stripe, and the app stores themselves. This direct line ensures the numbers you’re looking at are real and updated instantly. It’s the difference between buying based on a sales pitch and investing based on undeniable facts.

When you start with verified data, your initial screening becomes lightning-fast. You can filter for apps meeting your exact financial criteria, saving you from chasing dozens of duds. Explore the variety of apps for sale on marketplaces like What's the App, where financials are transparent from the start. This is how you spot apps with consistent, upward momentum before everyone else.

The Initial Vetting Framework: A Buyer's Checklist

Once an app catches your eye, perform a quick health check to decide if it's worth investigating further. This initial vetting is your best filter.

Zero in on these key areas:

Revenue Quality and Consistency: Look past the top-line number. Is the income steady and predictable, or is it from a one-off marketing blast? Consistent MRR is far more valuable than erratic revenue spikes.

Monetization Model Clarity: How does the app make money? A subscription model is often a golden ticket, signaling a stable, recurring revenue stream.

User Engagement Clues: Scan App Store reviews for recent positive feedback. Check the update history—an actively maintained app is a great sign.

This quick scan helps you build a shortlist of real, revenue-generating businesses worth a closer look.

The goal of initial vetting isn't to find the perfect app; it's to disqualify the wrong ones as quickly as possible. Your time is your most valuable asset.

Beyond the Numbers: The Seller Factor

A great app is almost always built by a great founder. Before getting too deep, investigate the seller's track record. Do they have a history of building successful apps? Are they respected in developer communities? A passionate, skilled founder usually leaves behind a clean codebase and a loyal user base.

Conversely, a seller known for flipping low-effort apps could be a major red flag. The quality of the founder often reflects the quality of the asset. This human element provides crucial context to the data.

Best Practices for App Valuation

So, what’s a mobile app really worth?

Getting this right is the most important skill for both buyers and sellers. It's the line between a home-run deal and a costly mistake. Valuation is part art, part science, but it always starts with one non-negotiable ingredient: verified data.

Forget optimistic projections. The only way to build a trustworthy valuation is to anchor it in real, verifiable numbers pulled directly from the source—like RevenueCat, Stripe, or the app stores. This raw data is your ground truth.

Understanding Valuation Multiples

Valuing a subscription app usually boils down to its profit or revenue, multiplied by a specific number (the "multiple"). The two most common models are based on Seller's Discretionary Earnings (SDE) and Annual Recurring Revenue (ARR).

SDE Multiple: This focuses on the total cash flow an app could generate for a new owner. It's calculated by taking the net profit and adding back discretionary expenses (like the owner's salary). A typical multiple is 2.5x to 4.5x of the annual SDE.

ARR Multiple: This is the go-to for high-growth subscription apps. It prioritizes top-line growth and market potential over immediate profit. Multiples can range from 3x to 8x—or even higher for apps with exceptional metrics.

The real skill is learning what factors push that multiple up or down. For a deeper dive, check out this comprehensive guide on how to properly value a mobile app.

What Drives a Higher Valuation?

Not all revenue is created equal. Two apps making $100,000 annually can have vastly different valuations based on the quality and stability of that income.

Here's what justifies a premium multiple:

- Low Churn Rate: A low percentage of subscribers canceling each month is the ultimate sign of a healthy, "sticky" product. An app with 2% monthly churn is a world away from one bleeding 10% of its users.

- Stable, Predictable Revenue: Buyers and investors pay for predictability. Twelve straight months of steady, organic growth is far more appealing than a revenue chart that looks like a rollercoaster.

- A Well-Defined Niche: An app serving a specific, passionate audience often fetches a higher price due to stronger engagement, lower marketing costs, and a clearer growth path.

- High Growth Velocity: Consistent month-over-month MRR growth of 10-15% without a huge ad spend screams "strong product-market fit" and justifies a higher multiple.

Valuation isn't just a math problem; it's about building a story. You're using verified data to understand an app's past, assess its present health, and project its future potential.

The global appetite for apps isn't slowing. The mobile application market is already valued at roughly $330 billion, with people spending 5.3 trillion hours in apps annually. Subscriptions are the star player, growing at a 16.5% CAGR. You can find more on the explosive growth of the mobile application market on Fortune Business Insights. Mastering valuation in this thriving market is a critical skill for any serious buyer or seller.

Due Diligence: A Buyer's and Seller's Checklist

"Trust, but verify."

This mantra is the heart of any app transaction. Once a potential deal is taking shape, the real work begins. Due diligence is a methodical deep dive to check every claim, verify every number, and uncover any skeletons in the closet before signing. For buyers, it’s an insurance policy. For sellers, preparing for it in advance demonstrates professionalism and builds trust.

The Four Pillars of Due Diligence

A rock-solid investigation is built on four critical pillars. Approaching due diligence this way ensures nothing is missed.

- Financial Diligence: Meticulously cross-reference every revenue and expense claim with original, verifiable source documents.

- Technical Diligence: This is like a full inspection before buying a car. It assesses code quality, stability, and hidden "technical debt."

- Legal & IP Diligence: This confirms the seller owns what they're selling and ensures there are no legal landmines.

- User & Market Diligence: This involves digging into the user base and the app's market position to understand its traction and staying power.

A structured framework is key. Our comprehensive due diligence checklist for buying an app can help organize requests and ensure thoroughness.

Financial Scrutiny: Verifying Every Single Dollar

Financial due diligence must be relentlessly granular. The number one goal is to confirm the revenue figures used in the valuation are 100% accurate.

A buyer should request read-only access to all key financial dashboards—RevenueCat, Stripe, Google Play Console, and App Store Connect. Screenshots or reports are not enough. While in there, compare dashboard numbers directly against the seller's Profit and Loss (P&L) statement. Next, trace payouts from these platforms to the seller's bank statements to ensure everything lines up.

A seller who hesitates to provide direct, read-only access to their financial accounts is a massive red flag. Transparency is everything. Any reluctance to share verifiable data should be treated with extreme caution.

This is also the time to put all expenses under a microscope. Ask for invoices for every major cost, like hosting, third-party APIs, and marketing spend. Understanding the true Customer Acquisition Cost (CAC) is vital for projecting future profitability.

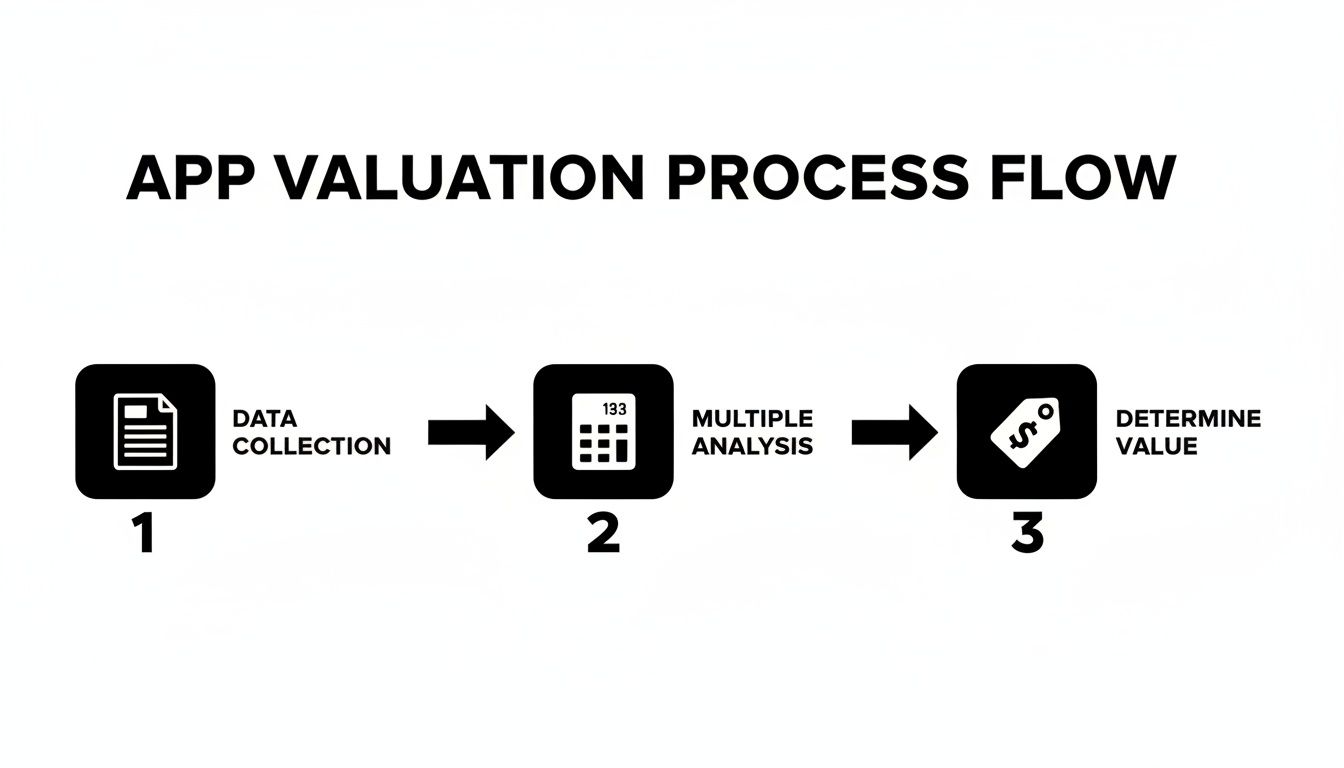

This simple flowchart shows how verifiable data is the bedrock of any sound valuation.

The process is clear: start with raw, verified data, apply a realistic multiple, and only then arrive at a trustworthy valuation.

Critical Due Diligence Red Flags

During an investigation, certain issues may arise. It's crucial to identify these red flags early and understand the risks they represent.

| Red Flag | Potential Risk | Action to Take |

|---|---|---|

| Seller refuses read-only access to financial accounts. | Revenue or user numbers are likely inflated or fabricated. | Walk away from the deal if they won't provide verification. |

| Revenue in P&L doesn't match bank deposits. | Hidden fees, chargebacks, or overstated revenue. | Demand a complete reconciliation of all transactions. |

| The codebase is messy and undocumented. | High technical debt will lead to costly and time-consuming future updates. | Get a quote from a developer for a code refactor and adjust your offer accordingly. |

| History of app store rejections or policy warnings. | The app might be at risk of being removed from the store. | Investigate the specific reasons for each violation to assess future risk. |

| Unclear ownership of source code or key assets. | You could be buying an asset you don't legally own, leading to lawsuits. | Require a signed "IP Assignment Agreement" from all contributors. |

| A sudden, unexplained spike in traffic or downloads. | The owner may have bought fake reviews or used bots to inflate metrics. | Scrutinize user acquisition channels for the period in question. |

This table highlights the critical thinking required. Every red flag is a signal to dig deeper or walk away.

Technical and Legal Investigations

Once the financials check out, it’s time to look under the hood. A buyer should hire a trusted third-party developer for a code audit to assess:

- Code Quality and Scalability: Is the code clean, well-commented, and built for growth? A messy codebase is technical debt that will cost time and money.

- Third-Party Dependencies: Are external libraries and SDKs up-to-date, secure, and properly licensed?

- App Store Compliance: A history of rejections or warnings from Apple or Google can indicate future problems.

On the legal front, the primary concern is confirming intellectual property (IP) ownership. The seller must prove they own the source code, brand name, domain, and all creative assets. A clean legal slate is essential for a smooth transfer.

Best Practices for Structuring and Closing the Deal

You've found an app, verified the numbers, and completed due diligence. Now it's time to make it official. The final price is just one piece of the puzzle. A well-crafted deal protects both buyer and seller and sets the stage for a smooth transition.

Thinking Beyond the All-Cash Offer

An all-cash offer is simple, but creative deal structures can often make a transaction happen that might otherwise be out of reach.

Seller Financing: The seller acts as the lender. The buyer puts down a significant chunk of cash upfront and pays the rest in installments. This reduces the buyer's initial cash burden and shows the seller has "skin in the game," demonstrating their belief in the app's future.

Performance-Based Earnouts: To bridge a valuation gap, a portion of the purchase price can be tied to the app hitting specific goals post-acquisition (e.g., an extra payment if MRR grows by 25% in the first year). This incentivizes the seller to ensure a successful handover.

Hybrid Deals: Most deals are a mix of different elements, such as a cash payment upfront, a seller-financed portion, and a small earnout. This flexibility allows for an agreement that meets both parties' needs.

The Letter of Intent (LOI): Your Deal Blueprint

Once the general structure is agreed upon, it's time to draft a Letter of Intent (LOI). This non-binding document outlines the major terms of the deal before engaging lawyers for the final purchase agreement. A great LOI sets clear expectations and prevents future misunderstandings.

The LOI is your acquisition blueprint. It’s where you hammer out the most critical terms—like the transition plan, what’s included, and closing dates—before you’re deep in the weeds with legal fees.

A protective LOI must cover these points:

- The Asset List: Be painfully specific about everything being purchased: source code, user database, domains, App Store listings, social media accounts, etc.

- Founder Support: Define the seller’s post-sale role precisely. Will they provide 30 days of dedicated email support? A few hours of calls per week? Get it in writing.

- The "No-Shop" Clause: This is a non-negotiable. It gives the buyer an exclusive period to finalize the deal, preventing the seller from shopping the offer around.

Getting the negotiation and deal structure right is about building the foundation for the app's future success.

Post-Acquisition: From Handover to Growth

Congratulations, the deal is closed! This is the starting line for the new owner. The next few months are critical. A smart, methodical transition separates a good investment from a great one. The technical handover must be complete, including the codebase, full admin access to app store listings on both Apple and Google Play, and control of all related domains and social media accounts.

The First 90 Days: A New Owner's Playbook

The first three months are foundational. This is a time to listen, learn, and stabilize, not for sweeping changes. The top priority is to understand the asset and build trust with the existing user base.

An in-app message or email introducing the new owner goes a long way. Let users know you’re committed to making the app better and ask for their feedback.

The post-acquisition phase is your greatest opportunity to add value. By focusing on quick wins and building a solid long-term strategy, you can often double or triple the app's initial MRR within the first year.

Quick Wins for Immediate Impact

While sketching out a long-term roadmap, look for low-hanging fruit to build momentum.

- Sharpen App Store Optimization (ASO): Could better keywords, screenshots, or a clearer description drive more organic downloads? A few hours of ASO can pay dividends for months.

- Improve Onboarding: Go through the user onboarding flow. Is it seamless or confusing? Improving the first-time user experience is one of the fastest ways to boost retention.

- Join the Conversation: Start responding to App Store reviews—good and bad. It publicly shows you’re listening and invested in the community.

The timing couldn't be better. The mobile app market is projected to rocket from its current $330 billion valuation to over $1 trillion by 2035, driven by compound annual growth rates between 14% and 17%. Nurturing and growing an acquired app is an incredibly valuable skill in this exploding market. You can find more on these growth stats at Mordor Intelligence.

Common Questions on Buying & Selling an App

Diving into the world of app acquisitions is exciting but can feel like uncharted territory. Here are answers to common questions for both buyers and sellers.

What’s a Fair Valuation Multiple?

While there's no single magic number, a healthy, profitable app often lands in the 3x to 5x range of its Seller's Discretionary Earnings (SDE). For high-growth subscription apps with strong Annual Recurring Revenue (ARR) and low churn, that multiple can climb even higher.

The multiple is just a starting point. A premium valuation is justified by factors like:

- Low user churn: This proves product-market fit and user loyalty.

- Consistent MRR growth: Predictable revenue signals a stable, healthy business.

- Strong niche positioning: A dedicated user base often means lower marketing spend and higher loyalty.

How Much Support Should a Seller Provide Post-Sale?

This is a critical deal point to define in the purchase agreement. A typical support period runs from 30 to 90 days, giving the new owner enough time to learn the ropes. This usually includes a set number of hours per week for calls and email support to answer questions about the code, marketing, or user base.

For buyers: you’re not just buying an app; you’re buying the playbook that made it successful. For sellers: providing good support ensures a smooth transition and protects your reputation.

Can I Buy an App if I Can't Code?

Absolutely. Many successful app entrepreneurs are not developers. The key is to partner with a trusted freelance developer or a small agency to manage the technical side. Factor this cost into your budget from the start by getting a quote for ongoing maintenance during technical due diligence. This turns a potential unknown into a predictable operational expense, not a barrier to entry.

Ready to find an app with financials you can actually trust? Check out the live listings on What's the App :)? and see what’s possible when every number is verified at the source. Your next great opportunity is waiting at https://whatsthe.app.